OPINION: The federal government is considering rolling out the big stick against the big banks – warning them to invest in branches across regional Australia or face the financial consequences.

Reports late last year from Treasury indicated it was considering a regional services levy which could force banks to each pay millions of dollars more if they fail to keep rural and regional bank branches open.

It was estimated some of the big players like Westpac could pay more than $100 million a year under the levy, Commonwealth Bank about $75 million, Macquarie Bank $75 million, ING $60 million and HSBC $20 million.

It has also been suggested city-based banks could buy credits from regional banks or banks with a regional presence, to offset their own lack of rural banking services.

Country towns throughout Australia have weathered the brunt of branch closures – Gunnedah included.

Gunnedah’s ANZ branch closed its doors in 2023 after more than 50 years operating in the community.

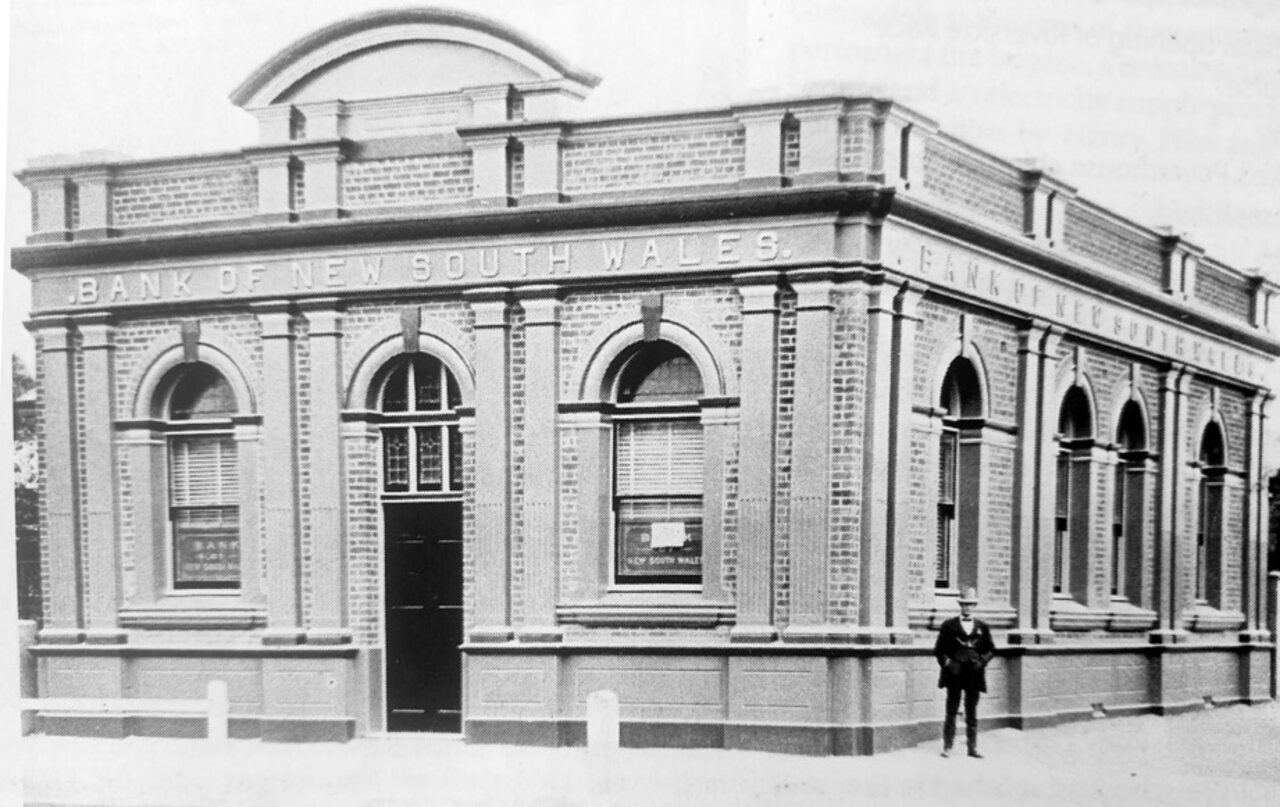

The closure came alongside the branches being shut across the New England North West region including at Wee Waa and Gilgandra. In Moree, both the Westpac and ANZ branches closed – Moree’s Westpac branch had operated since 1876 – even before Federation!

The bank levy suggestion follows the federal upper house inquiry into regional bank closures. Chaired by Senator Matthew Canavan, the inquiry heard there were 92 bank branch closures across the country in just a matter of months in 2023.

After 13 public hearing’s and 608 submissions, the inquiry last year handed down its report which included eight key recommendations to government.

Unsurprisingly, the ideas now being considered by Treasury appear very similar to those recommended by the inquiry.

One of the inquiry’s recommendations suggested a policy recognising access to financial services as an essential service and should commit to guaranteeing reasonable access to cash and financial services for all Australians.

Most of us are connected online more than we’ve ever been and the banks are acutely aware – leaning on this premise to close more rural branches. But not everyone is up to speed and many customers, particularly the elderly in rural communities, still rely on face-to-face banking. A policy which confirms banking as a vital service would have to be a good thing.

Other interesting recommendations suggest the government investigate the feasibility of establishing a publicly owned bank – either as a stand-alone public bank or one associated with, and using the branch network of Australia Post. Although I’m not sure how people would feel giving even more of their hard-earned (this time voluntarily!) back to the government but would give some control, and ownership of the country branches.

The inquiry recommended government “urgently” develop a mandatory Banking Code of Conduct, with a robust branch closure process, to be administered by a regulator with expertise in consumer protection. This regulator would be authorised to approve or defer any closure request, only after banks had carried out “meaningful consultation” with communities, prepared thorough reports on potential impacts and fully fund transition arrangements – before a branch is closed.

Another recommendation was for government to lead a Regional Community Banking Branch Program to help underwrite the establishment of ‘community bank’ branches. Local communities would be required to raise their own capital as well, but the government contributions could help lower the required amounts, the recommendation states. According the report, the bank levy would only help fund the capital needed for this community bank program, because let’s face it, a few million dollars is chump change for most big banks.

In this sense, the levy can’t really be seen as penalty – it’s more like a charitable donation to those less fortunate – in this case, the government.

To order photos from this page click here