Gunnedah Shire Council will proceed with its special rate variation (SRV) application despite ongoing objection to the proposed rate increase.

It follows last week’s extraordinary meeting of council – the first for 2025 – where feedback from the recent round of community consultation on the rate increase was presented to elected members.

All councillors were present except Robert Hoddle who was an apology.

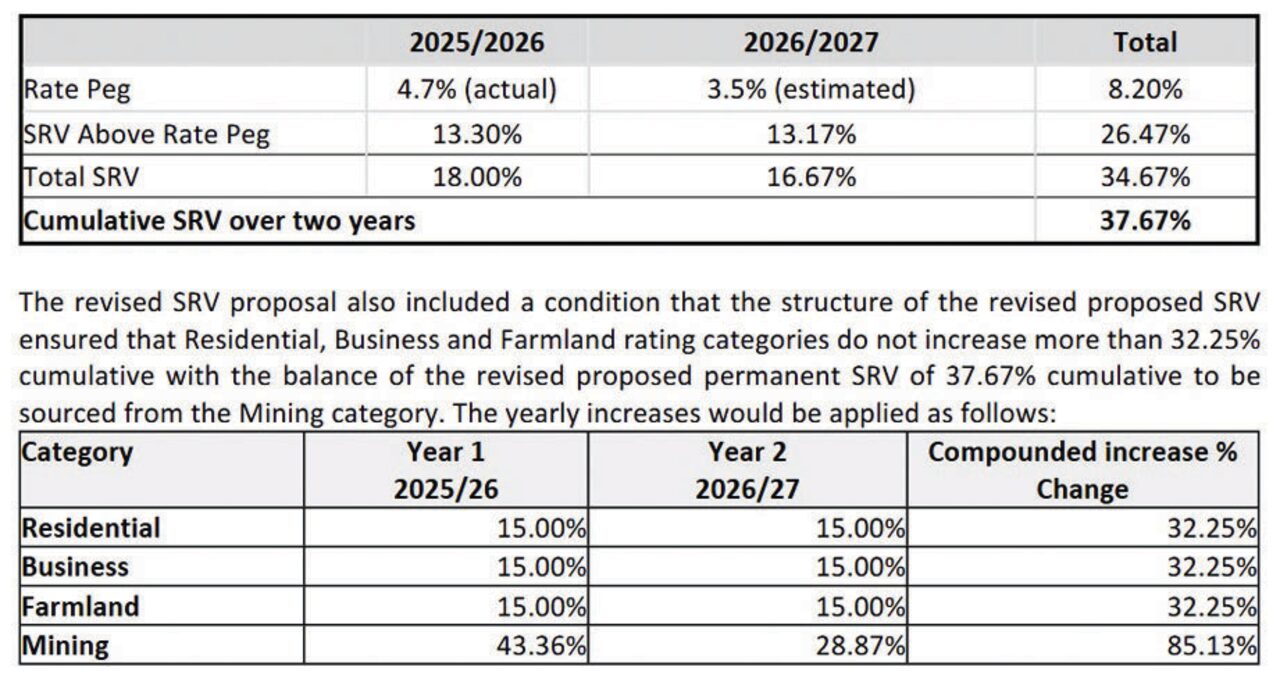

The latest consultation revealed more pushback on the proposed, permanent two-year 37.67 per cent cumulative increase, highlighting rising cost-of-living challenges.

This is despite a compromise where residential, farmland and business rate categories would pay a capped 32.25 per cent increase (over two years) and the balance sought from the mining rate category.

“Of the 27 submissions received, most expressed strong opposition to the proposed rate rise, citing concerns about the impact on farmers and businesses already facing financial strain,” council’s Community Consultation Report stated.

Council acknowledged that while many of the respondents indicated they did not want a special rate variation (SRV), there was also strong support for levels of service to at least be maintained or even improved, which would not be possible without an SRV.

“Council also has compliance obligations under the NSW Local Government Act 1993 to ensure that council is financially sustainable and also ‘to provide guidance to enable councils to carry out their functions in a way that facilitates local communities that are strong, healthy and prosperous’,” council’s business paper said.

“However, council is cognisant of the cost-of-living pressures facing the community and the impact that an increase in rates will have for ratepayers in the current economic climate. While there certainly are some positive indicators in the local economy including a low unemployment rate, relatively affordable housing costs compared to coastal and urban areas and strong construction and mining industry activity, it is recognised that council’s proposal for an SRV will be an added impost to any households or businesses that are already struggling financially.

“This impost will be lower in the revised SRV proposal for residential, business and farmland and higher for the mining sector than the original SRV scenario. It will also be partly offset with council’s resolution ‘that council freezes increases to waste management and sewerage annual charges during the proposed Special Rate Variation (SRV) implementation period, subject to the SRV being approved by IPART and those service areas maintaining a financially sustainable outlook.'”

Some farmland ratepayers described this sewerage charge freeze as “discrimination” given they are not connected to those services and so could not access the same concession as other ratepayers.

Farm owners also took aim at council’s general approach to recovering revenue through the SRV.

“For over 50 years I have had to manage my business based on projected income without the luxury of being able to increase commodity prices to manage a shortfall. Surely council must do the same, a rate rise of over 30 per cent is offensive and places a heavy burden on all ratepayers,” the submission to council stated.

Other rural ratepayers suggested farmland should be totally immune from any increase.

“If there is to be any SRV, I believe that farmland rates should be completely exempt because we are paying about four to five times as much for an unfairly small benefit which is diminishing greatly,” the submission said.

Much of the feedback from farmland ratepayers suggested the increased rate burden associated with the SRV should be recovered by a user-pays model and allocated to residential ratepayers.

Council’s Community Consultation Report argued “the flip side of this discussion is that the rural ratepayers use a larger portion of certain assets per ratepayers, for example there are a number of roads that may service as few as 2-3 households”.

Council highlighted that although much negative feedback was received during the consultation process, 39 per cent of the independent phone survey respondents were “somewhat supportive” of the original 38.88 per cent SRV option. This proposal would have featured a 24 per cent increase in the first year, followed a further 12 per cent in the second.

The report said the phone survey included 300 participants, and based on Gunnedah LGA’s population size, provided a 95 per cent confidence level in broader community sentiment.

Council also responded to questions from the community about why it had not acted sooner to implement a revenue adjustment.

“Up until this point council has been able to manage within the available funding as it has had access to significant levels of non-recurrent grant funding and had built up internal cash reserves for infrastructure renewal and replacement. However, the point has come where grant funding has significantly declined and the internal cash reserves have been utilised and are not able to be replenished,” council’s business paper said.

Other feedback included a view that council should ensure it is operating as efficiently as possible, is engaging with the community and is transparent in its decision-making.

Council said that in addition to its decision to apply for the rate increase, it also agreed to strive to achieve $930,000 in efficiency gains over the next three years.

It also committed to regular public reporting on savings and efficiency gains and ongoing engagement with the community. Council said it is also continuing to advocate that the state and federal governments to return total taxation revenue provided to local government for operational purposes to 1 per cent of total taxation revenue, as this has reduced to approximately 0.55 per cent.

Capacity to pay

The ‘Capacity to Pay Report’ was also presented to council last week ahead of its decision on the special rate variation.

This document was in recognition that certain ratepayers may possess greater financial capacity to meet rate obligations than others.

By the end of the proposed SRV period in the 2026/27 financial year it is estimated that:

•average residential Gunnedah rates will increase by $383, or $7.38 per week;

•average residential village rates will increase by $188, or $3.63 per week;

•average farmland rates will increase by $1721, or $33.10 per week;

•average Business Gunnedah rates will increase by $2241, or $43.11 per week;

•average mining rates will increase by $269,530, or $5183 per week.

The above increases include the rate peg that would ordinarily apply but the impact of these rises would vary throughout the Local Government Area depending upon the relative value of the land for each property.

In determining general capacity of resident to pay the increase, the report noted that household savings were on the rise.

“Reviewing indicators such as household expenditure showed that household net savings have increased to $24,218 per household in 2022/23 (slightly lower with regional NSW averages), these increases in net savings indicate a capacity to pay within the community,” the report stated.

The report also highlighted Gunnedah Shire Council “has a relatively low proportion of outstanding rates at 3.86 per cent (2024)”.

According to the report, this was “a strong indicator of both capacity and willingness to pay rates especially given that the benchmark for outstanding rates is less than 10 per cent for regional and rural areas”.

A break down of the rate percentage increases for each category over two years. Once implemented, the rate increase would be permanent.

To order photos from this page click here